XRP continues to have an impressive gathering, forming a new all-time high (ATH) in July. Prices have dropped slightly since that peak, but the XRP remains within a notable distance of the $3.66 ATH.

Historically, XRP struggled in August, but this time it may differ, with positive market signals on the horizon.

XRP investors are aggressive

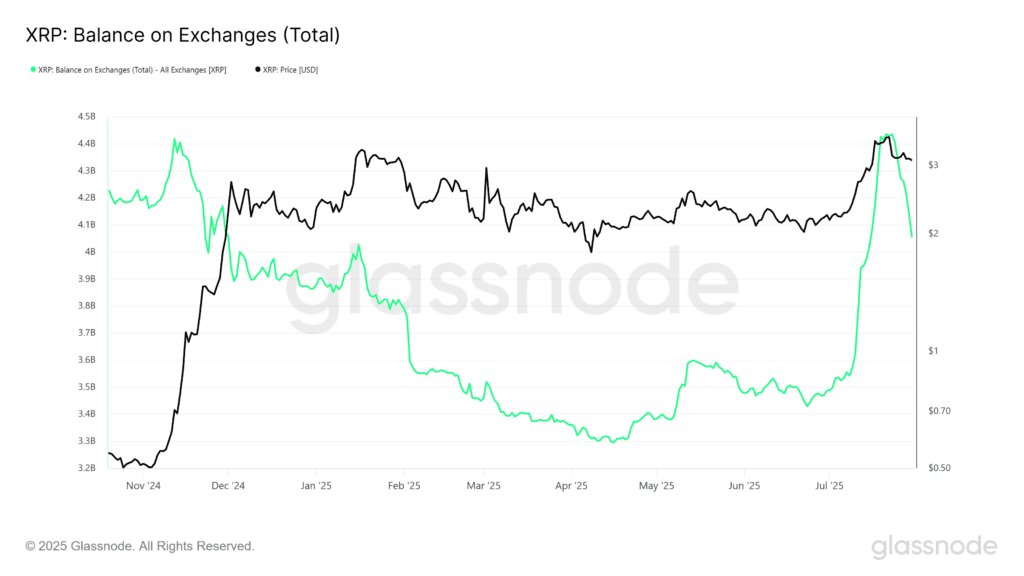

XRP’s recent market activity has shown a dramatic shift in investor sentiment. Over the course of two and a half weeks, over $2.846 billion XRP was sold to the exchange, informing them of a significant amount of profit gains and sending supply to eight months high. However, Yellow Network captain Alexis Silkia told Beincrypto that the season for sale is short-lived.

“This kind of post-sales sales are business, especially in a market where you still have confidence in. Importantly, this last ATH, most retail and institutional players used breakouts as an opportunity to eliminate risk. But I think the pressure is temporary.

Just a week later, investors have surpassed XRP of over $1.2 billion, exceeding XRP of over 400 million. This rapid reinvestment highlights a strong confidence in XRP’s future performance, indicating that market sentiment is shifting towards optimism.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

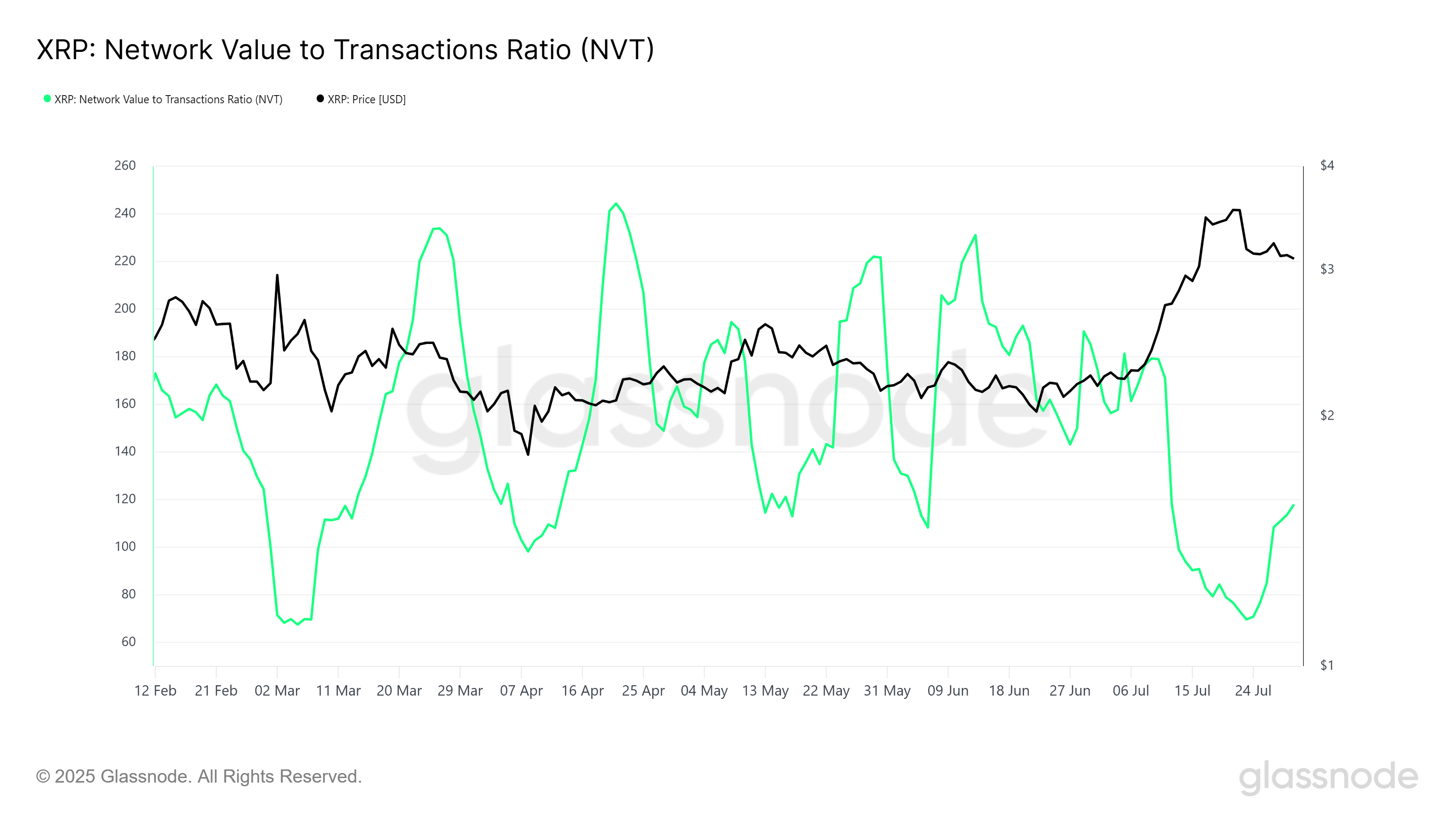

XRP macromomentum is supported by positive technical indicators, particularly NVT (network value to transaction) ratio. This ratio is currently at its five-month low, indicating that the network value has not yet exceeded transaction activity. This is very important for XRP as it shows that the cryptocurrency is not overheating.

Without pressure on inflated network values, XRP would be better positioned to experience steady growth without the risk of serious corrections. This sets up potential recovery and meeting stages, especially given healthy transaction activity in the XRP ledger.

Can XRP prices bounce back?

Currently, XRP is trading at $2.99, slipping into a major support level of $3.00. Altcoin is still above 22% from its $3.66 ATH, but the potential growth base remains strong. Historical data show that August usually brings bearish momentum to XRP, with a median monthly return of -6%.

However, given the strong purchasing activity and positive technical indicators observed recently, August this year could be against normal trends. If XRP can secure support above $3.41, Altcoin can push towards the ATH again. Sirkia also discussed with Beincrypto about what the future of XRP looks like.

“Institutions that have been on the market for a while are gaining momentum. Meanwhile, even in a macro environment where funds are turning risk… XRP stands not hype, but with regulations and infrastructure. That’s going to end in the long run.

However, there is a risk on the negative side. If XRP can’t retrieve $3.00 in support, the price could drop to $2.65, which will disable bullish papers. Drops to this level could mark a 4-week low and lead to further sales pressure.

What to expect from XRP in August 2025? It first appeared in Beincrypto.