This month has been extremely bullish for the crypto market so far. Bitcoin (BTC) hit a new all-time high over a week ago. Ethereum (ETH) is also continuing to meet, reaching its months high. In fact, in the past 24 hours alone, the total market capitalization has increased by $41 billion.

Within this, market watchers are increasingly predicting their next move. Analysts are currently looking at classic metrics to measure luxury watch prices, historic market cycles, and market trajectories.

How luxury watches reflect market psychology: The “Rolex Indicator” explained

Key technical indicators, chart patterns, fear and greedy indices, Bitcoin domination, and DXY performance have become increasingly popular tools for predicting trends in the crypto market.

However, some analysts argue that behavioral metrics provide a more accurate and insightful view of the market. In a detailed post about Pseudonymous Analyst PIX X (formerly Twitter), he highlighted the “Rolex indicator” as a potential tool for predicting the top of the market.

Analysts explained that Rolex indicators measure market psychology by examining users’ behavior regarding luxury items such as watches. When new money enters the market, individuals will purchase status symbols like clocks to show success.

Pix pointed out that it only peaked after a widespread wealth distribution, such as the 2021 NFT boom, and watch prices have historically lagged behind the code bull’s running. This spike marked the peak of the bull market.

“What makes this useful is that the luxury market is behind. It’s not that much, but it’s enough. You can see it in your data. You chase the cryptography along the way, peaking a little later, then collapsed almost in sync.

Analysts added that Bitcoin has reached a record peak, with many altcoins seeing double-digit surges over the past month. However, luxury watches have not followed suit.

“The fact that the clock is rising again doesn’t mean we’re on top. But that means we’re already a decent part of the cycle. People don’t start buying symbols until they feel the difficult part is over. It usually lies somewhere two-thirds of the cycle. Wealth is accumulated.

Another analyst, Atlas, shared similar sentiments. He emphasized that while greed is increasing, it has yet to reach its full potential.

Additionally, analysts outlined more signs of action. He noted that “flex culture” rise on Crypto Twitter, profit screenshots and posts pursuing jobs are indications that change market sentiment. There are more posts like this than six months ago, but they are still below the level of 2021.

“There are emotional changes, but it’s not completely euphoric…

Benner or Buffett: Discussion of the next big move in the market

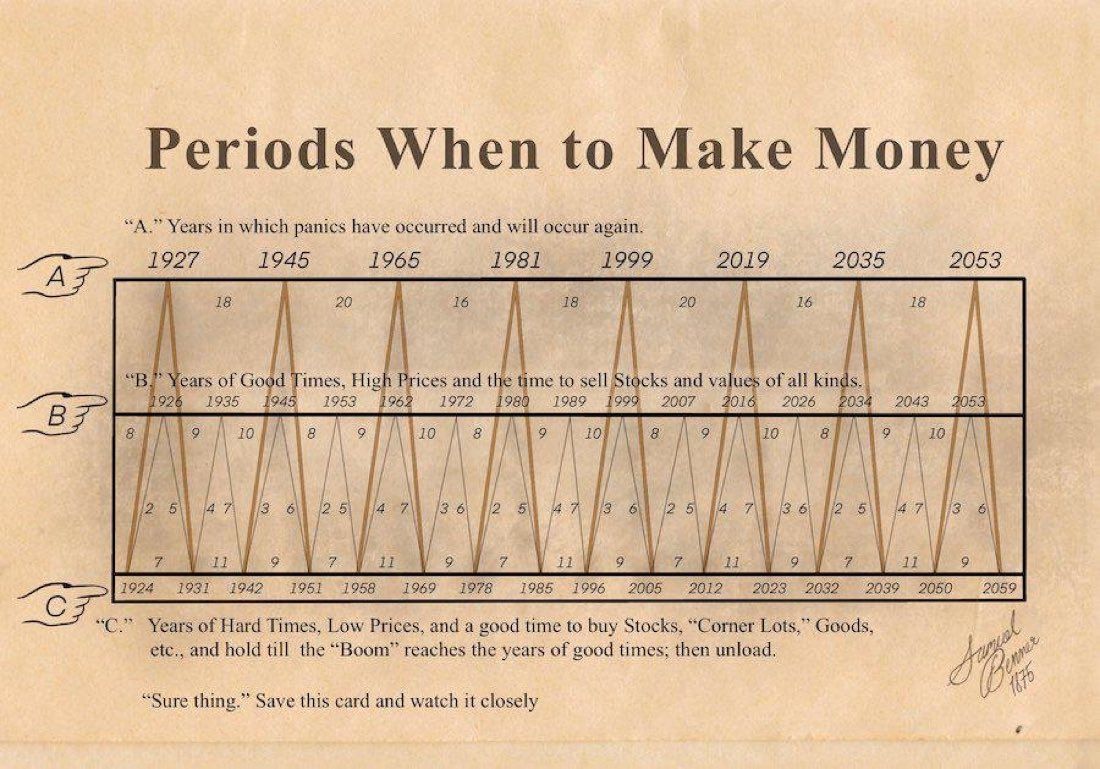

Meanwhile, the Benner Cycle, a historic model rooted in repetitive market patterns, offers a similar outlook. According to the cycle, the market has not yet reached its peak and could do so by 2026.

So it shows that there is still room for growth. This suggests that current market conditions may represent stages of accumulation and positioning before significant upward movements.

“2026–2032 = ‘B Year” → Surge in liquidity. Reevaluation. Exit zone. 2035–2039 = “Year” → Panic. crash. “Loads of drawdowns,” the user pointed out.

Nevertheless, the Warren Buffet indicator presents notes of caution. This metric compares the total capital of the country’s stock market with gross domestic product (GDP). Warren Buffett calls this ratio A

“It’s probably the single best measure of where the rating is.”

It is used to assess whether the stock market is overvalued or undervalued compared to its underlying economy. Typically, values above 100% indicate that the former is true. In particular, in July, the ratio exceeded 200%.

It could be a signal that the market is in a bubble or that the stock price is overly bulging. This raises concerns about potential revisions to risk assets, including cryptocurrencies.

The juxtaposition of these indicators highlights the market at intersections. The Rolex indicators and the Benner cycle refer to continuous growth, while the Buffett indicator warns of overheating. The next move from Crypto Market could depend on whether confidence is converted into a speculative overabundance or causing a broader reassessment of the assessment.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.