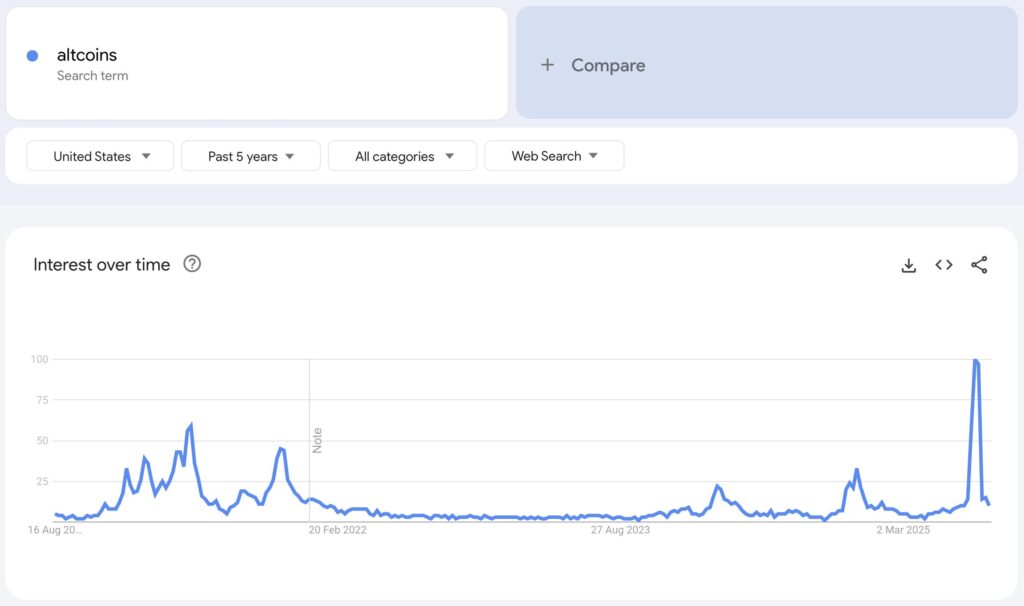

Recently, the term “Altcoins” brought interest to Google’s trends soaring, quickly reaching the all-time high (ATH). However, within just a week, the search volume had collapsed dramatically.

This raised a big question: Was the so-called “altcoin season” nothing more than a short-lived fantasy?

Altcoin season hype occurs rapidly as Google trends rush

Many investors treat Google trends as indicators to assess fresh retail interests. Historically, when there is a trend in Google’s crypto-related terms, new capital often flows into related projects.

Something unusual happened in August. US Google Trends Data showed that searches for “Altcoin” surged to new highs but returned to bottom in just a week.

This was not limited to the US. On a global scale, Google Trends recorded searches for “Altcoin” with a maximum score of 100, collapsed to 16 within a week. A similar “pump and dump” pattern was displayed with “alt shop” and the name of the altcoin at the top.

“Google searches for Alt season were pumped and dumped faster than bundled memo coins,” Mario Nawfal’s Round Table laughed.

The charts suggested that it could have ended as soon as the Altcoin season began. The market capitalization of Altcoins (Total3) reflects this trend. It rose from $1 trillion to $1.1 trillion over the same period.

Some analysts are optimistic. Cyclop, the right analyst for X, believes that the “Altcoin” keyword Spike still has a positive meaning. He argued that the term became mainstream.

“Altcoin Spike means there’s more interest than in 2021, but perhaps because there are 1000 times more coins now and “Altcoin” has become a popular term. At the time, people said “Crypto.” So, I think this basically shows that interest is beginning to be picked up, but that doesn’t mean we’ve reached a peak,” Cyclop said.

There are also other reasons why Google’s trends may no longer be effective in measuring fresh retail demand. Investors are currently using AI tools to search for information. The broader market concept is so familiar that many investors no longer have to look into them on Google.

Aug’s fragmented altcoin season

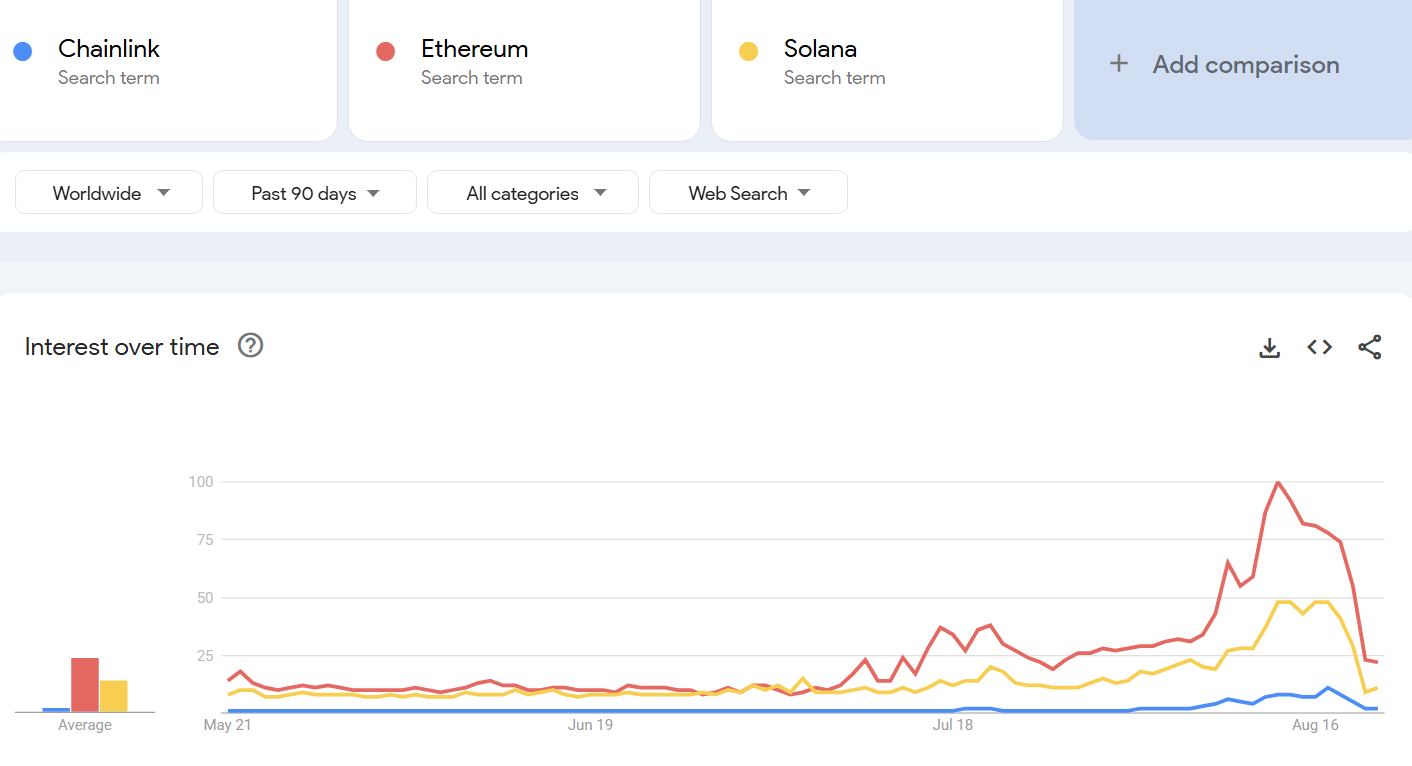

Artemis data provided deeper insight into how the Altcoin season unfolded in August.

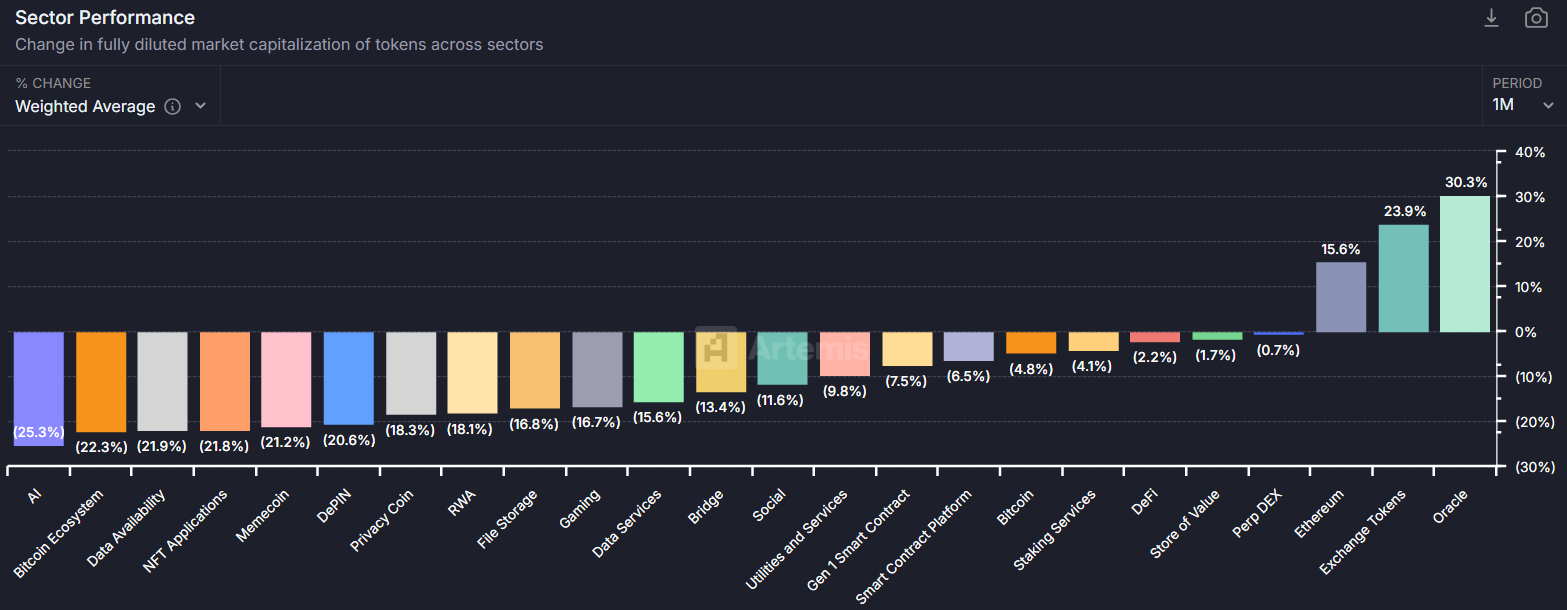

Some altcoins were strongly tied, but most categories have found negative performance over the past month. Only three stories worked well: Ethereum, Exchange Tokens and Oracle.

ETH has benefited from the accumulation by publicly available companies. The Exchange Tokens category has been unlocked due to BNB and OKB meetings. Oracle Tokens, on the other hand, was superior mainly thanks to the price surges of ChainLink.

Each successful Altcoin had a driver. OKB rises for large token burns. Links obtained from the Chain Link Reserve Plan. As a result, the Altcoin season remained fragmented and did not meet investor expectations.

Sandeep, CEO of Polygon, presents a discussion about why future Altcoin seasons are likely to have fewer tokens going through important gatherings compared to previous cycles. He highlights the important differences in intrinsic values.

The 2017 and 2021 Altcoin seasons thrived primarily through marketing, but today’s well-versed investors are looking for the practicality and practicality of the tokens they choose to invest in.

“This is what I’m telling me: Retailers have not yet bought stories. The old Altcoin season was driven by speculation and promises, stories and marketing. Institutional money is smarter money. Sandeep said.

Still, analysts have not given up hope in the broader altcoin season. Crypto Exchange Coinbase and Asset Manager Pantera Capital predicted that the new Altcoin season could begin early in September.

The reason why the hype of the Altcoin season collapsed just a week later was its first appearance in Beincrypto.