Plume Network (Plume) has surged strongly after the blockchain project (RWA), which focuses on tokenization of real-world assets, was listed on Binance.

However, sales pressure quickly overwhelmed demand, dragging prices even lower than before the listing news. This article points to the central issues that shape investors’ feelings.

Short-lived rallies and sudden crashes in August

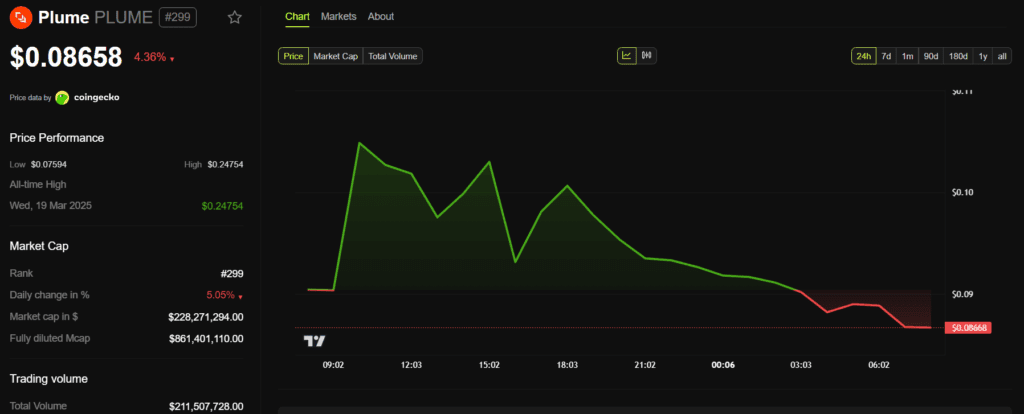

After the Binance list, Plume surged over 30%, exceeding $0.11. The rally came from community hype and influx from retailers. The 24-hour trading volume exceeded $200 million, a 10-fold increase compared to the previous day.

However, according to beincrypto data, the plume was on a roller coaster immediately. Its price fell sharply in a short time, falling to $0.0865, causing losses for FOMO traders.

On-chain trading community Evening Traders Group discovered that before Binansu announced its listing, it sent all the plumes of accumulating accumulations to exchange. The whale has achieved real profits of over $1.66 million from the plume.

Binance lists are usually considered very bullish. However, this sharp decline reflects the profit-raising sentiment from short-term investors.

It highlights investors’ concerns about Ploom’s talknomic structure and internal sales pressure.

Pressure from tokens unlock schedules and unlock holder reductions

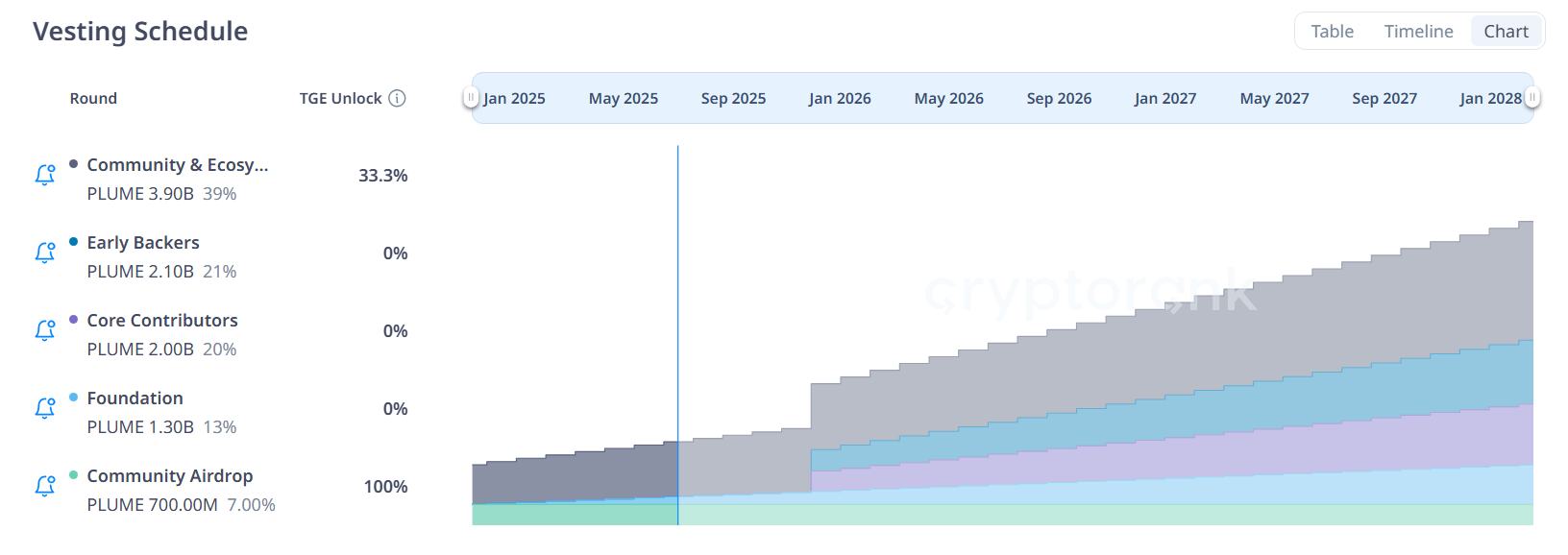

Another important reason for the plume losing momentum is the fear of investors’ unlocking schedules.

According to Cryptorank, more than 70% of Plume’s supply is still locked. However, on August 21st, more than 108 million plume tokens unlocked. 1.08% of the total supply then unlocks each month.

This schedule creates ongoing sales pressure. Early investors and token holders may sell to earn profits.

Quickly unlocking such a large number of tokens will increase circular supply and allow prices to be reduced, especially if there is not enough market demand to absorb new tokens.

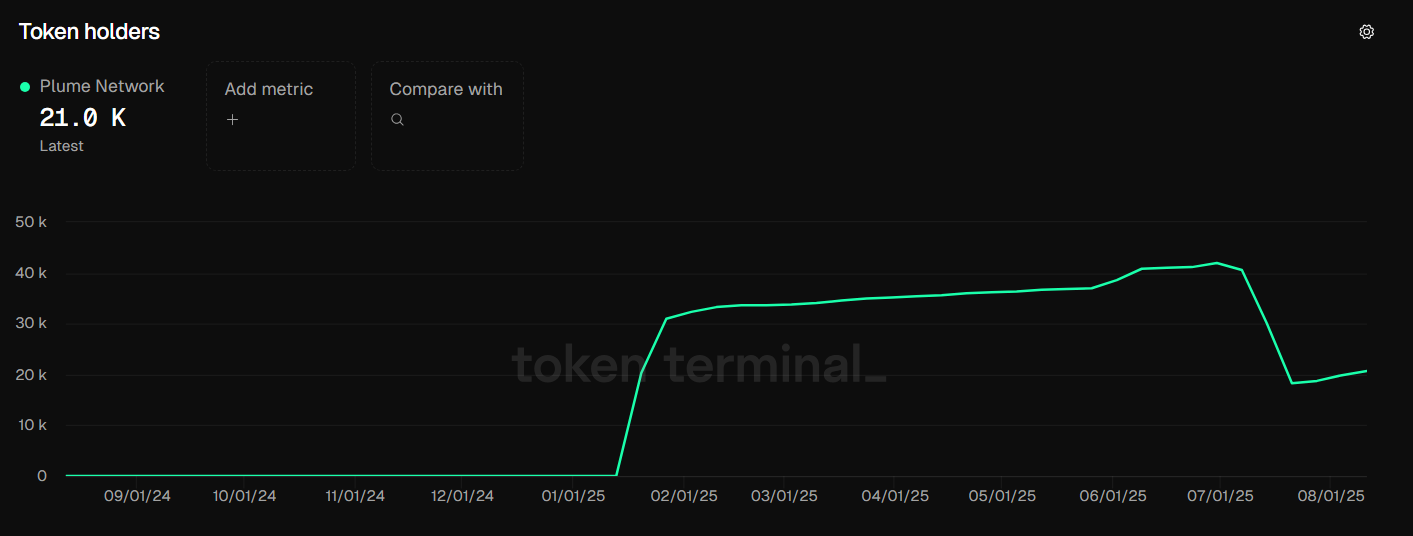

Furthermore, Tokensel Terminal data shows that the number of plume holders rose sharply in July, reaching a peak of 42,000. However, that figure fell 50% in August as many investors abandoned the project.

This reduction can be attributed to disappointment after the plume failed to maintain its early gathering. It may also reflect risk perceptions regarding unlock schedules. Losing so many holders with a short signal fades the reliability of the project.

Furthermore, a JPMorgan report noted that RWA tokenization has caused positive predictions, but that its real-world performance is slower. Retail investors have yet to show little interest in the sector in 2025.

Positive signs to bet on plume

On the positive side, some investors argue that Plume’s recent surge in trading volume (Binance’s list) can help the project get more attention.

“The Plume was just listed on Vinance today and the volume is insanely high. Following the announcement, the Plume (Volume) has risen 1200% in price over the last 2-3 days. This is crazy. It tells everything about the Plume Network since its launch.

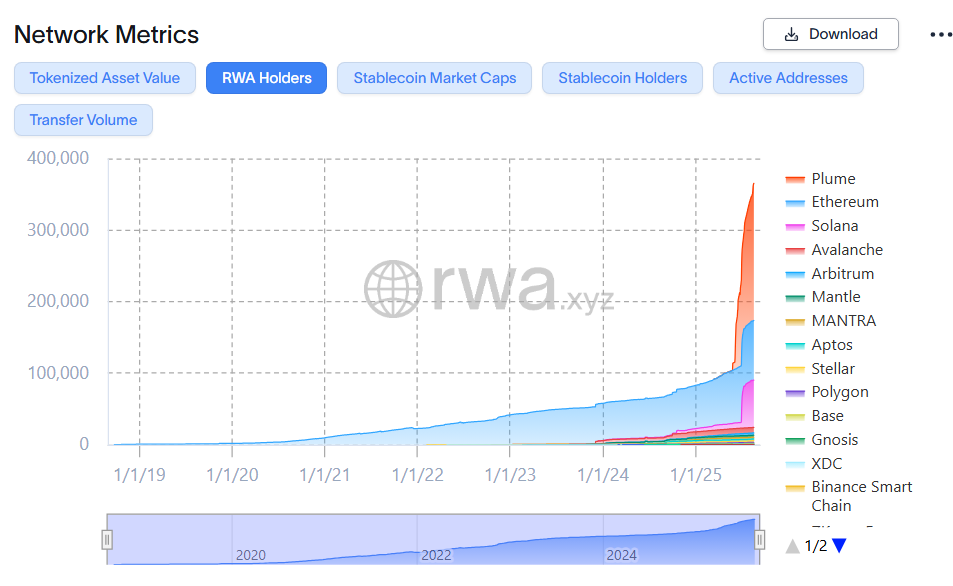

Furthermore, data on RWA.xyz shows that Plume currently has the largest number of RWA holders compared to other networks.

Plus, the Plume Network total value locked (TVL) exceeded its all-time high of $254 million in August. It was only $25,000 in April. In other words, it has grown to 1,000 times. This reflects the network’s extended applications.

So, Plume token prices have fallen, but Plume Network still has the opportunity to recover if the project continues to prove its actual value.

Why Plume Network (Plume) couldn’t keep profits after the first appearance of the Binance list in Beincrypto.