XLM is one of the more closely watched Altcoins over the past few weeks. Over the past three months, XLM prices have made a profit of nearly 50%. However, the momentum is fading. Last month it fell by 7%, then last week it cut another 7.5%, bringing a 5.4% decline in the last 24 hours alone, making the market weaknesses even wider.

Traders are questioning the durability of XLM’s breakouts as sellers are pushing harder. On-chain and technical indicators show complex situations. While most signs indicate weakness, one dataset suggests that a particular group of holders may be quietly constructing their positions.

Spots and derivatives show weakness

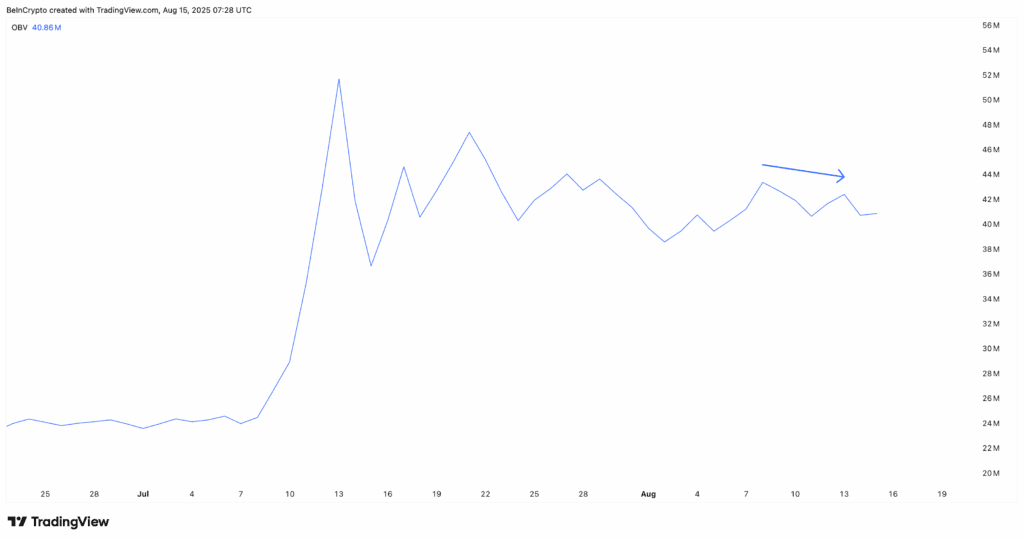

The first red flag is market participation. The XLM price achieved a high on the price chart (between August 8th and August 13th), while the On-Balance Volume (OBV) printed a low high. This suggests that spot buying interests are not following the same momentum. This difference shows that assembly is full of lighter purchasing pressures, limiting sustainability.

In derivatives, the stories are similar. Stellar’s Futures Open Interest is on a steady slide, falling from about $420 million in mid-July to about $260 million at press time.

This drop shows leveraged traders are retreating, often reducing the speculative fuel types that help maintain breakouts. The market’s immediate stance is leaning carefully, both in spot demand and in fading leveraged exposures.

Open interest (permanent) on futures is the total value of all aggressive permanent futures contracts that have not been closed or resolved, indicating how much capital is committed to the market at a particular time.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Long term holders are brighter and short term hands step in

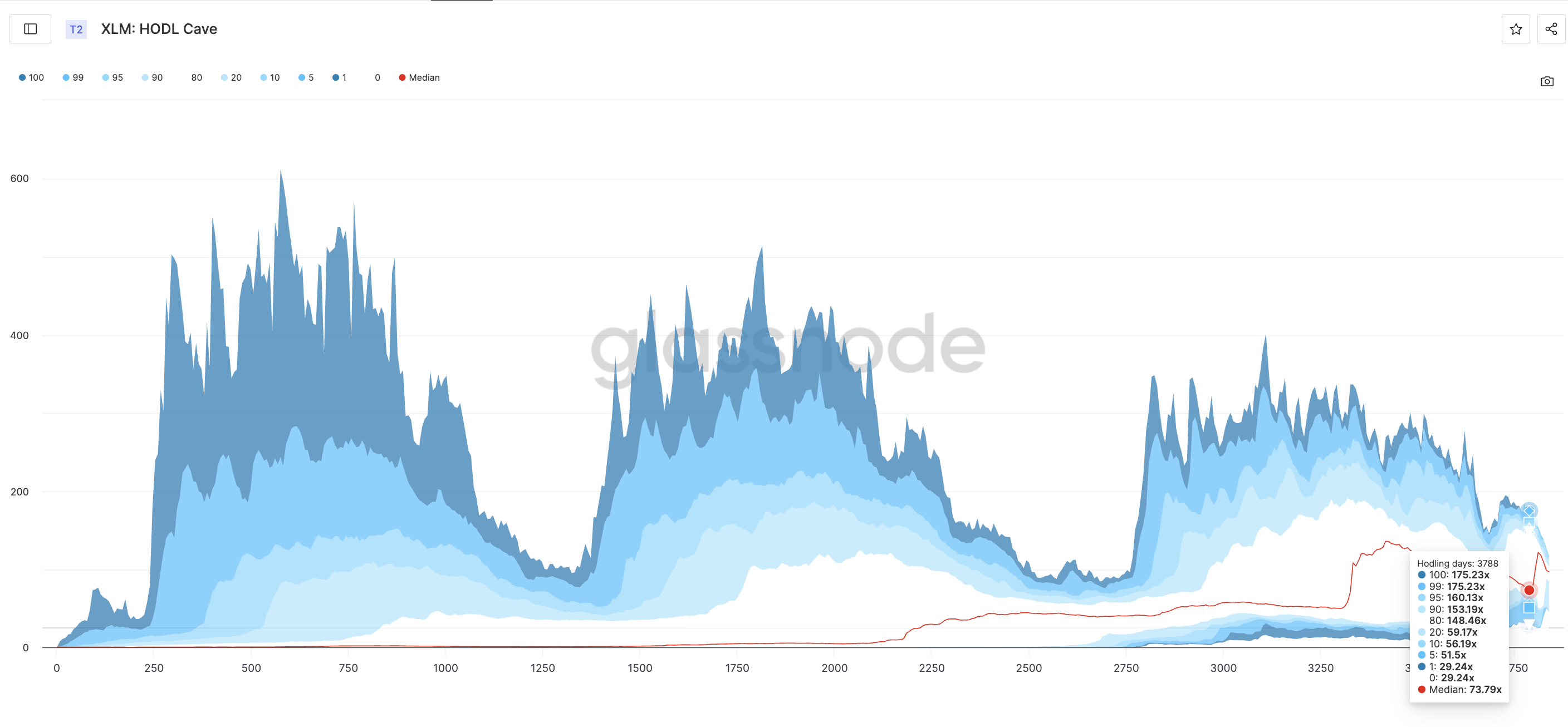

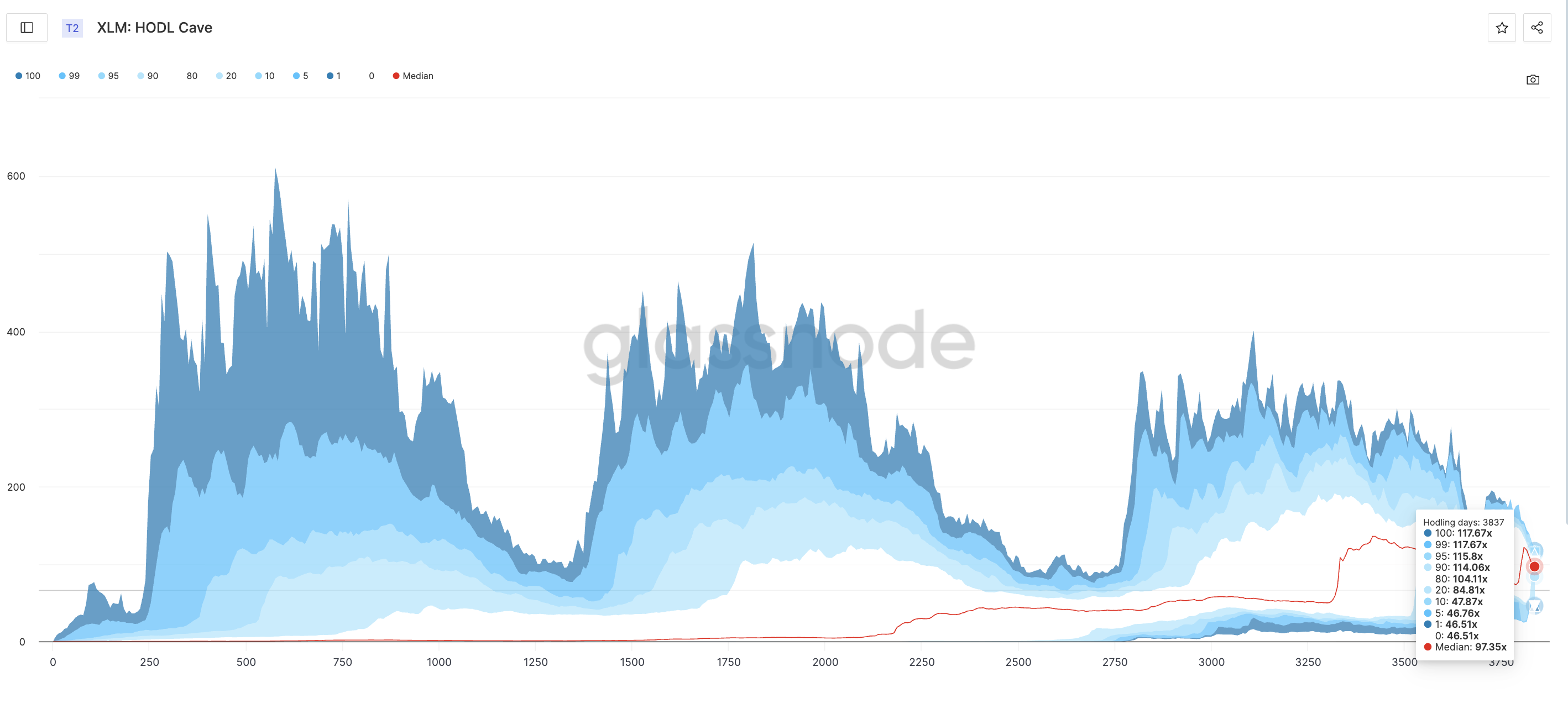

The HODL Cave Metric maps the distribution of historical returns for XLM holders across different percentiles at the current time point (day 3,837).

For example, a 100th percentile value of 117.67 times means the best performing ones that offer at least 117.67 times the profits for all historic holding periods during that period.

Between days 3,788 and 3,837, the median historical return (50th percentile) of XLM increased from 73.79 to 97.35 times. However, this increase hides the rotation:

The highest percentile bands (100, 99, 95, 90, and even 80) are falling sharply. This shows that the highest historical returns for long-term holders are low, consistent with profits from older coins. The lowest percentile bands (0, 1, 10, 20) are rising strongly (e.g., 20th percentile from 59.17x to 84.81x). This indicates that even the weakest historical returns for short retention periods have improved.

This pattern suggests that old, high-return coins are being sold to the market, but new buyers are stepping in and achieving stronger, short-term profit multiples. In other words, long-term holders are distributed, while fresh participants are selectively accumulating during debilitating.

When combined with Spot and Futures data, the photos are still mixed. The spot volume and obv remained soft, but futures positioning failed to show sustained accumulation. Both of these metrics indicate that momentum buyers are not yet in force. However, the improvements in the low percentile band within the HODL cave indicate that at least a portion of the market is quietly positioned.

Key XLM price levels show movement surrounded by range

XLM prices currently trade at nearly $0.42 and are within two key zones. Losing $0.40 (key support) can trigger the slide towards $0.38 and $0.36. The advantage is that if you collect $0.46 (key resistance), you will be able to see $0.48, and if you pass that level you may be set to retest a local high of $0.52.

However, in the past few trading sessions, XLM prices have moved within this support resistance zone, hinting at indecisiveness.

For now, the chart says the base is soft. However, HODL’s cave metrics suggest that short- and medium-term buyers may be quietly positioned for their next leg. If XLM’s price loses $0.36, the entire bullish trend will fade. This is to open the door to the new swinglow.

The price of XLM posts faces deeper pullbacks, but it is possible that one cohort is quietly purchasing DIP.