XRP has been trading quietly near the $3 mark with minimal movement in the last 24 hours, earning just 3% profits over the past week. Still, it has grown 35.4% over the past three months, indicating a steady long-term uptrend.

The mix of whale activity, reduced exchange balances, and price action near major levels suggests a possible breakout.

Whale adds $750 million to XRP

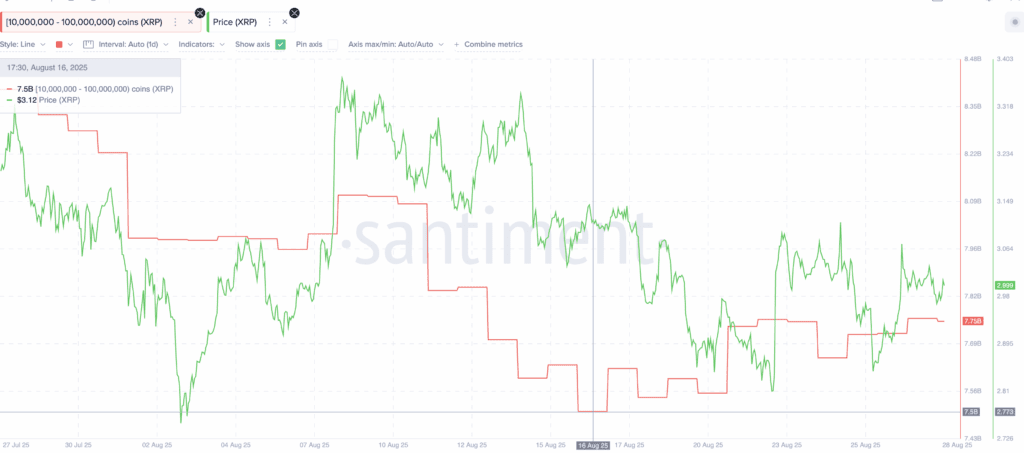

One of the clearest signals often comes from large owners known as whales. The group, which has held between 10 million and 100 million XRP since mid-August, has added around 250 million tokens.

At a $3 valuation, this amounts to around $750 million in new accumulation. Whales are usually purchased in size when they expect a stronger price. Their steady addition suggests confidence that even if XRP prices remain flat, an upward trend could be built.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Exchange balances fall to the lowest level in a year

Whale activity lies alongside another important metric: XRP balance and exchange balance. Over the past three weeks, exchange reserves have fallen from XRP 3.77 billion to XRP 3.27 billion, down approximately 13.3%.

This marks the lowest level in a year. Less XRP on exchanges means less immediate sales pressure is often associated with less immediate sales as traders move coins to their wallets to hold rather than sell them.

In the past, similar drops lined up at the rally. For example, between May and June, a sharp decline in reserves followed by a price increase of $2.10 to $2.32 within days. Following the chart, local bottoms specific to the exchange balance led to previous XRP price increases.

Therefore, this past year reduction in XRP exchange balance could serve as a major breakout catalyst.

XRP Price Action and Breakout Levels

These signals feed directly into the current XRP price action. For a few weeks, XRP has been trading in range and has struggled to push higher.

The first row of sand remains at $3.01, serving as a tough resistance. Interestingly, this level has once again reduced the price of XRP.

More than that, it comes in $3.16. However, the actual breakout test is $3.33 and there is a cluster of price rejections. A powerful daily closing that exceeds this mark could pave the way for an all-time high at $3.65.

The bullish outlook is invalid at $2.72. If it breaks, the XRP price could hit a new local low.

Until then, XRP prices are balanced. The whale has been purchased, the replacement spares have been reduced, and the momentum appears to be ready. If the signal matches, traders can quickly see if the XRP has the strength to ultimately penetrate high.

Post-XRP price analysis reveals breakout catalysts as whales add $750 million, the first to appear in Beincrypto.