Zora’s price performance has become bearish in the last 24 hours, sliding further down from its new all-time high of $0.105.

The recession marks the onset of a profitable cycle following a decline in whale activity and a slight increase in exchange inflows.

The Zelkova whales will be dropped out when the token approaches peak – has the correction come?

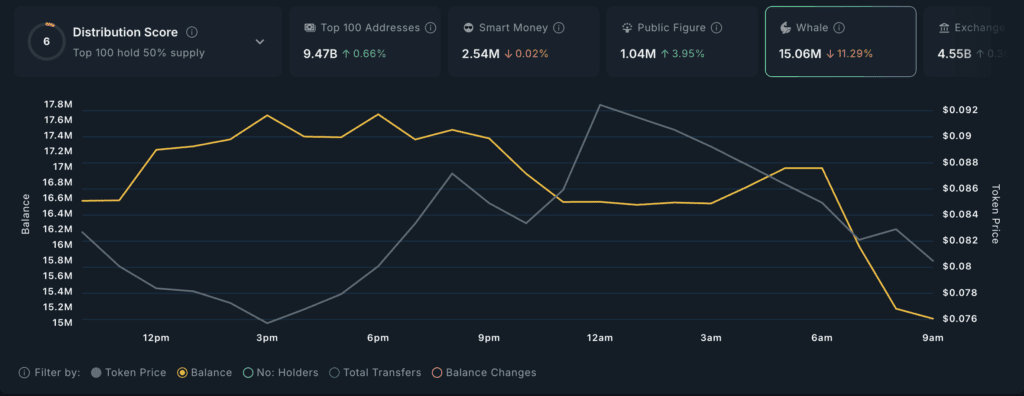

Data from Nansen reveals a sharp decline in Zola’s massive holder activity over the past 24 hours.

According to on-chain data providers, high-value wallets (the balance held by high-value wallets with over $1 million Zola) fell nearly 11% in a day, indicating a significant change among key stakeholders.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The sudden pullback comes after Zora’s rally reaches a record high of $0.105. As the volatility and uncertainty of the rising market creeps into the wider altcoin space, whales appear to trim exposure while the token price remains high.

This wave of profits from whales can also cause a domino effect among retailers. Confident in the weakening of short-term trends, smallholders tend to follow suits, which could exacerbate downward pressure on Zola prices.

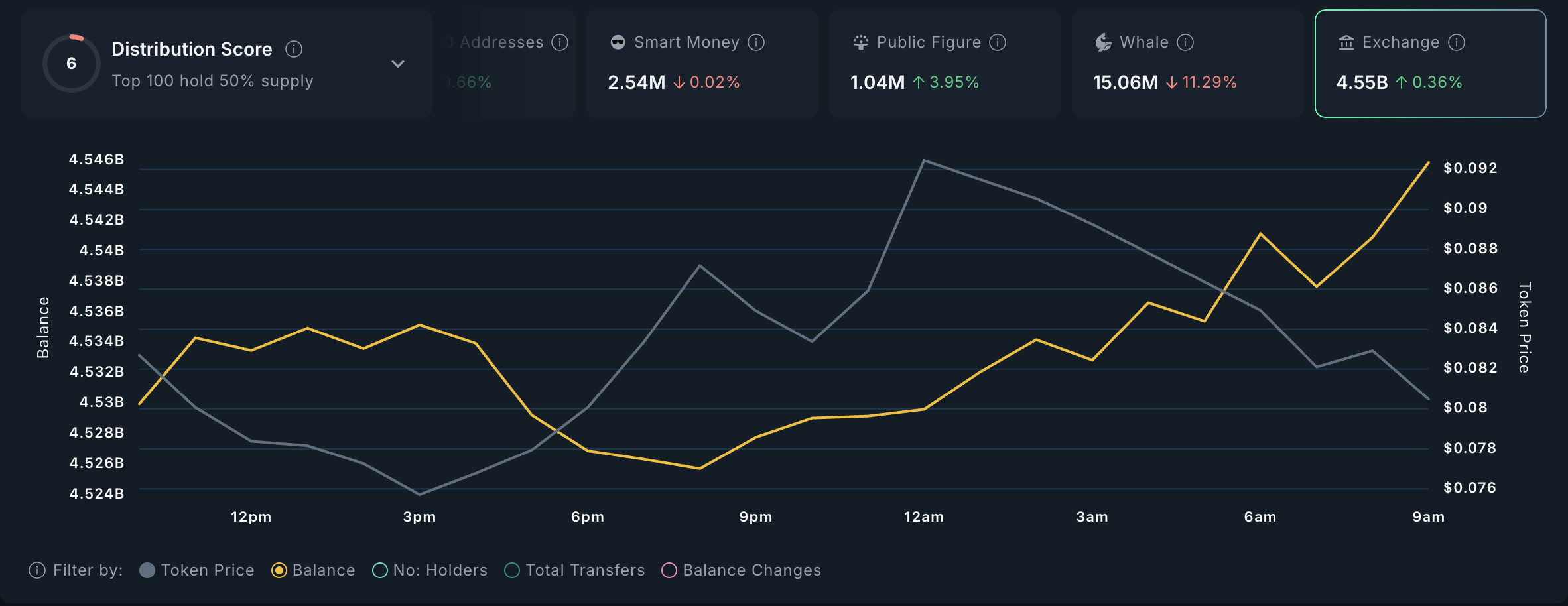

Additionally, Zora has noticed that its holdings have risen by 0.36% across the exchange over the past day. This suggests an increase in the number of tokens sent to trading platforms since Zora hit a record high.

If the exchange inflow of assets rises rapidly, it is often a sign that the holder is preparing to sell. The rise in flow combined with a decline in DIP and buy-side momentum in whale activity, creating bearish pressure and in the short term the possibility of Zola price corrections.

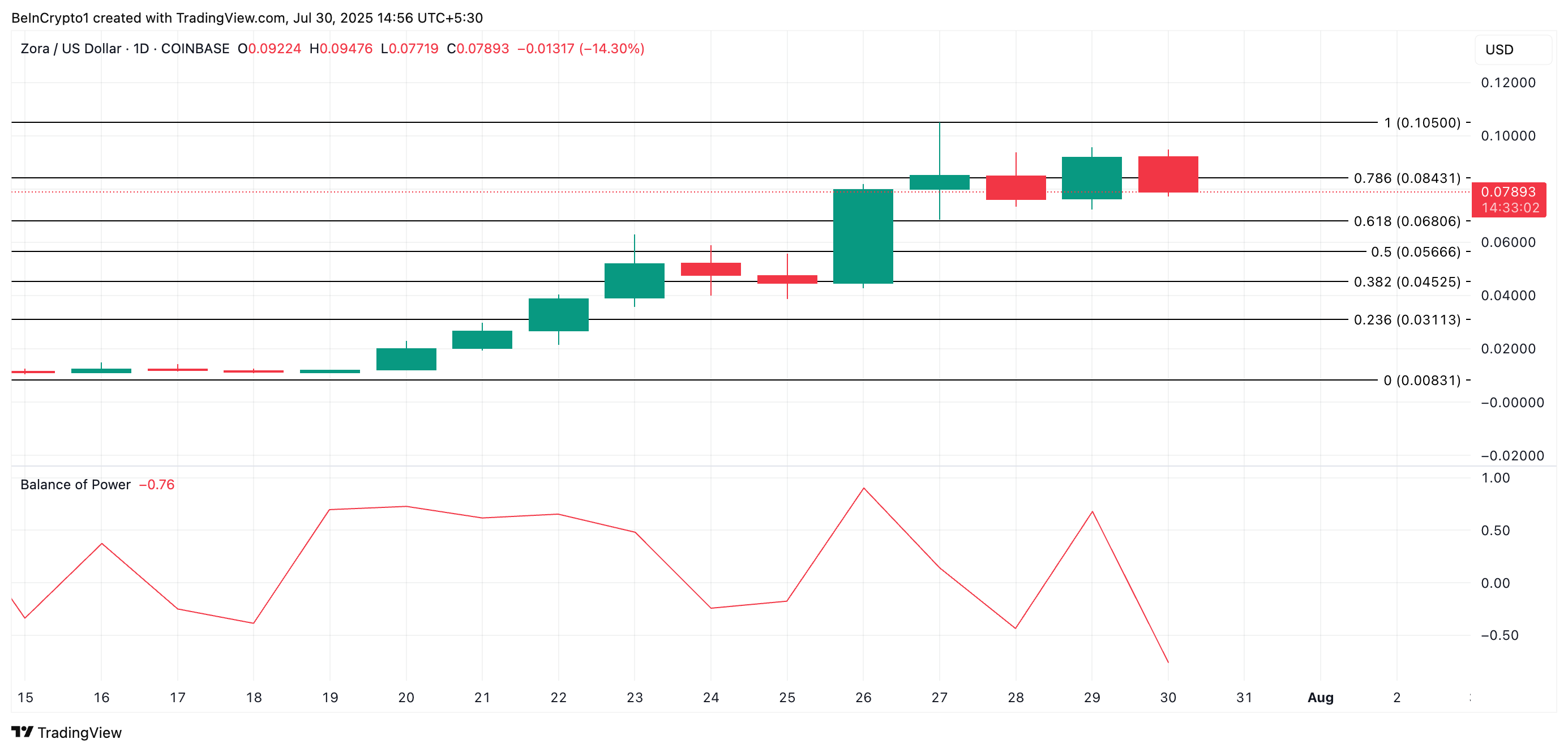

Zora becomes weaker when the seller leads

From a technical standpoint, Zola’s Balance of Power (BOP) indicator is negative at press, highlighting a clear drop in purchasing pressure. At press, the momentum indicator for measuring trading pressure is -0.76

This suggests that the Bulls are losing control, and sellers are beginning to decide on the direction of the market.

If this continues, Zora’s price could plummet to $0.068.

Meanwhile, an increase in buy-side strength could cause a violation of resistance at $0.084, which could cause the rally to return to $0.105.

Postzola shows signs of fatigue after all, as the reversal first appeared in Beincrypto.